Market Report Summary for May 2023

Updated June 2nd, 2023

- The average home sold price in the Greater Toronto Area (GTA) decreased 1.4% year-over-year to $1,196,101 for May 2023.

- The number of Toronto home sales increased on an annual basis for the first time since November 2021.

- Detached home average price increased by 0.5% year-over-year to $1.56M.

- Semi-detached home average price decreased by 0.6% year-over-year to $1.20M.

- Freehold townhouse average price increased by 5.1% year-over-year to $1.12M.

- Condo apartment average price decreased by 2.9% year-over-year to $748k.

Greater Toronto Area (GTA) Housing Market Overview

|

All Property Types

|

Detached

|

Semi-Detached

|

Freehold Townhouse

|

Condo Apartment

|

|---|---|---|---|---|

|

$11,96,101

Avg. Sold Price

3.7% increase

(1-month change) 1.4% decrease

(12-month change)

|

$15,56,566 Avg. Sold Price

4.5% increase

(1-month change)

0.5% increase

(12-month change)

|

$11,98,185 Avg. Sold Price

5.5% increase

(1-month change)

0.6% decrease

(12-month change)

|

$11,17,696 Avg. Sold Price

2.2% increase

(1-month change)

5.1% increase

(12-month change)

|

$7,48,483 Avg. Sold Price

3.4% increase

(1-month change)

2.9% decrease

(12-month change)

|

|

9,012 Transactions (Buy/Sell)

19.7% increase

(1-month change)

23.7% increase

(12-month change)

|

4,049 Transactions (Buy/Sell)

17.4% increase

(1-month change)

20.3% increase

(12-month change)

|

787 Transactions (Buy/Sell)

24.9% increase

(1-month change)

4.7% increase

(12-month change)

|

824 Transactions (Buy/Sell)

29% increase

(1-month change)

13.0% increase

(12-month change)

|

2,568 Transactions (Buy/Sell)

18.9% increase

(1-month change)

39% increase

(12-month change)

|

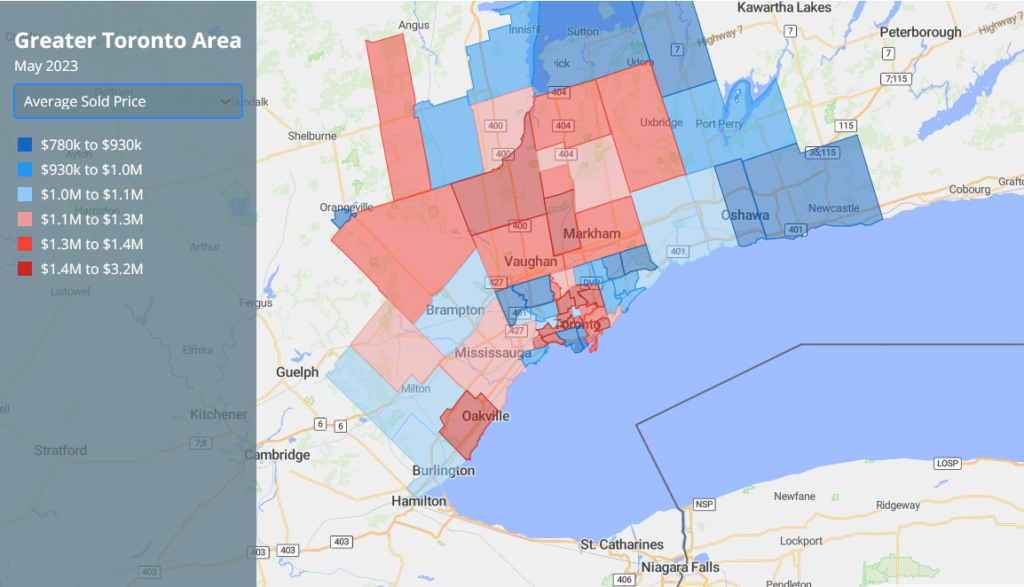

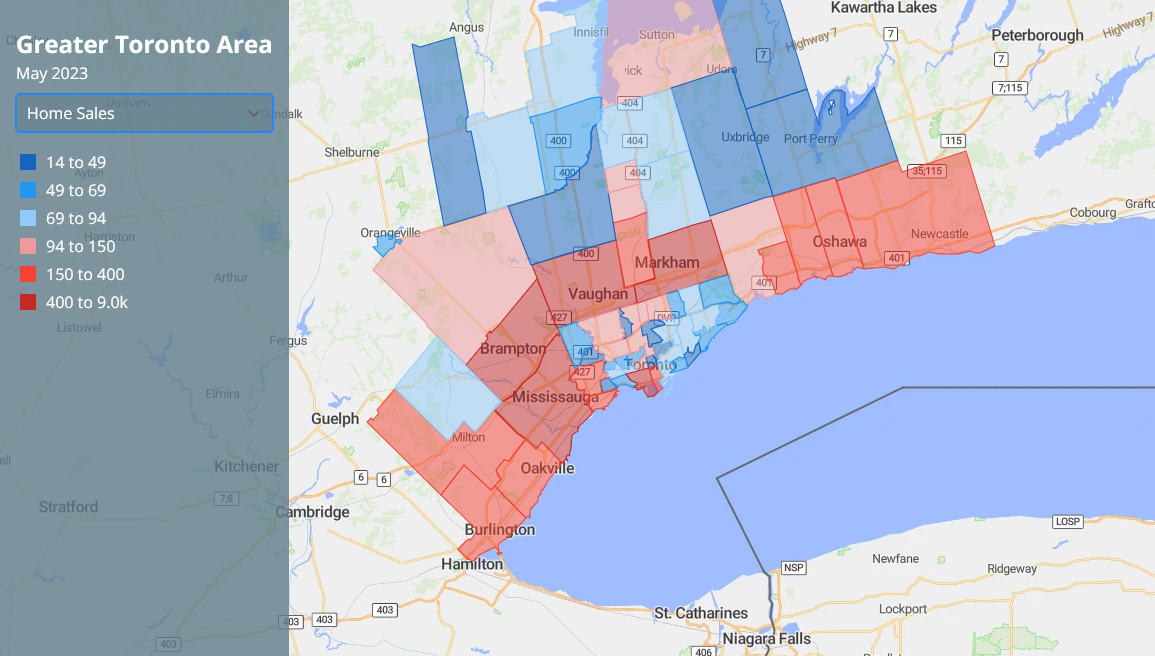

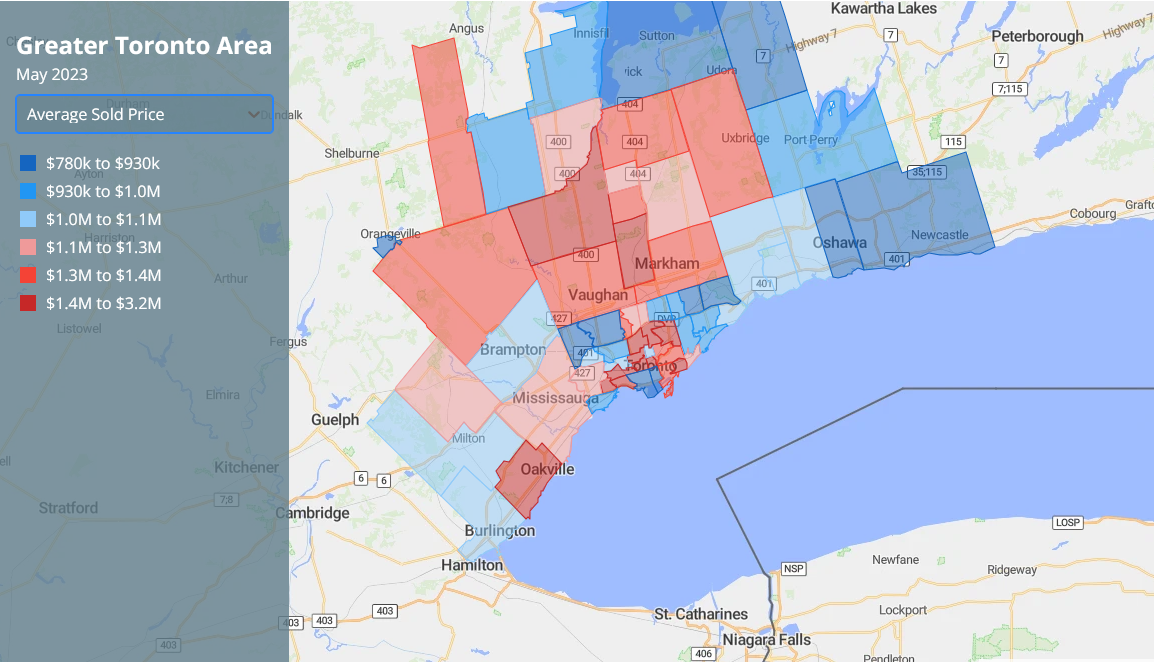

Toronto’s housing market is heating up as strong sales and a tight supply continues to push up the price of homes in the Greater Toronto Area (GTA). The average GTA home price in May 2023 was $1,196,101, a 4% jump from last month, the highest that it has been in almost a year. This comes off the back of a 23-month low in prices seen just a few months ago in January 2023. Even so, this means that Toronto’s average home price is still 1% lower compared to this same time last year.

There were 9,012 home sales in the GTA in May 2023, a 24% increase compared to May 2022. That’s the first time that the Toronto housing market has seen a positive year-over-year change in sales since November 2021! Compared to last month, sales are up 20%, and shows that there is strong demand from Toronto home buyers.

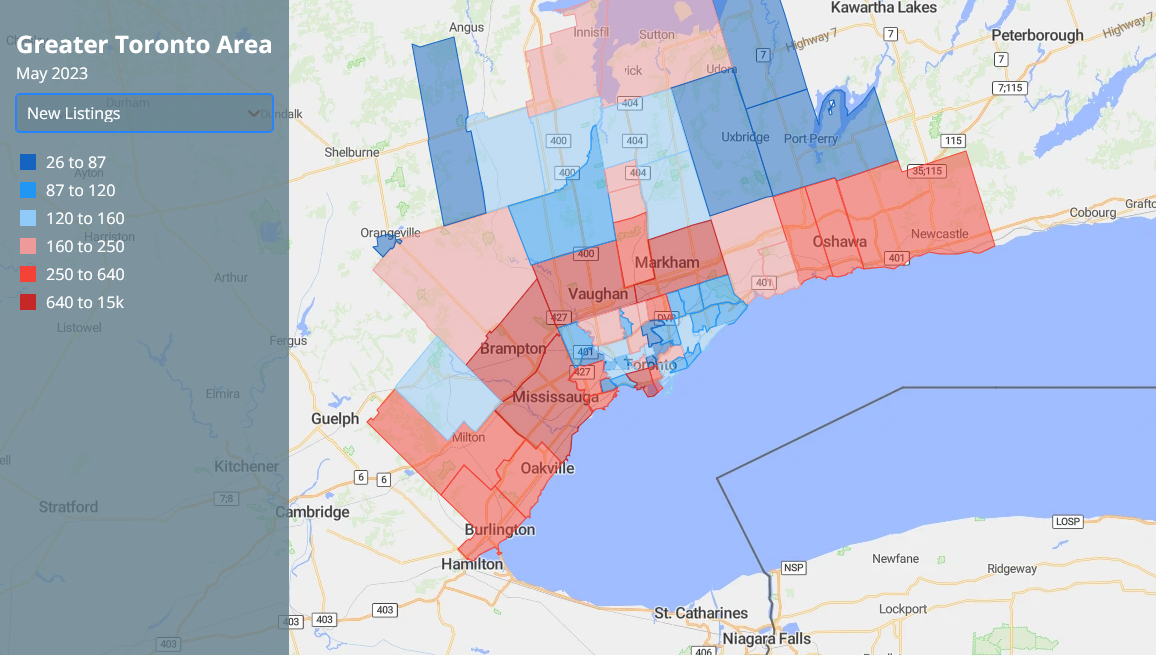

Enthusiastic buyers rushing to the market have been met with a rather limited supply of homes. 15,194 new listings were made in May 2023, a decrease of 19% year-over-year. When this 19% year-over-year decrease in new listings is combined with a 24% year-over-year increase in sales, it’s clear that competition for homes will continue to build. This may put upwards pressure on Toronto home prices.

This also pushes Toronto’s sales-to-new-listings ratio (SNLR) to 59%, a sizable difference from the 39% SNLR seen last year. An SNLR above 60% indicates a seller’s market, where homebuyers compete to purchase homes as there is less inventory on the market. While it’s just below that 60% mark, it is trending up. This increase in competition can push prices up, benefitting sellers but making it more difficult for buyers to find a home. Limited supply in the GTA might be nudging the market back towards a seller’s market.

Used to look at the price of an “average” home, the GTA’s benchmark home price for May 2023 was $1,164,400, down 7% year-over-year.

Regional Comparison

City of Toronto home prices are surging, up 7% compared to last month, a further increase from the previous 6% monthly gain the month prior. This brings the average home price in the City of Toronto to $1,197,021 for May 2023, a strong showing compared to other areas of the GTA. Despite these massive monthly gains, City of Toronto home prices are still down by 3% year-over-year. That highlights the significant losses that homeowners in the city have seen over the past year. This swift recovery in prices may come as welcome news to some.

Brampton’s average home price of $1,111,067 and its 2% month-over-month increase has once again lagged behind Mississauga’s significant 6% month-over-month price growth and $1,140,328 average home price. That’s unlike the dramatic rise and subsequent fall in Brampton home prices seen in 2022, when it outperformed many of its neighbours in the GTA housing market.

Home prices in York Region, which includes Markham, Vaughan, and Richmond Hill, have increased 0.5% month-over-month to $1,369,724. This means that York Region home prices are also up by 1% year-over-year, a rare positive annual price gain. Halton Region, which includes Burlington, Oakville, and Milton, has instead seen a 1% month-over-month decrease in home prices to $1,273,198. In Durham Region, Oshawa’s housing market has seen a 3% increase in prices month-over-month to $855,682.

Property Types

Looking again at the Greater Toronto Area, some property types are now experiencing an year-over-year increase in average prices, something that the Toronto housing market hasn’t seen since 2021.

The average price of a detached home in the GTA was $1,556,566 in May 2023, a 0.5% increase year-over-year and up 4.5% month-over-month. For semi-detached homes, the average price was $1,198,185, down 0.5% year-over-year and up 5.5% month-over-month. That’s the largest year-over-year price decline out of all property types this month.

The average price of freehold townhouses was $1,117,696, up 5% year-over-year and up 2% from last month. This brings freehold townhouses close to going back into positive year-over-year price change territory, and the largest annual gain out of the property types in Toronto’s housing market. The average price for condos was $748,483, down 3% year-over-year and up by 3% month-over-month.

Glossary and Definitions

MLS® HPI: The MLS® Home Price Index (HPI) is an index by the Canadian Real Estate Association (CREA) that tracks the prices of homes in a neighborhood. It allows Canadians to quickly compare home prices across Canada and between periods of time without having to account for specific features of a property. Unlike market prices, which can fluctuate from month to month based on seasonal dynamics, the HPI provides a stable view tracks trends across a longer period of time. The HPI is reviewed every year in May to adjust for changes in the real estate marketplace.

MLS® HPI Benchmark Price: The MLS® Home Price Index (HPI) Benchmark Price is the HPI translated into a real-world price number.

Strata Insurance: Strata insurance is insurance used by a strata like a condominium to covers damages to common areas and assets and liability to the strata. It can also include fixtures built or installed as part of the original construction of each unit, even though these may not be common structures. The insurance can cover:

- Buildings and structures associated with the strata including common areas such as the roof, parking garages, driveways, gyms, pools, etc.

- Liability for any property damage or bodily injury suffered on strata property

- Any fixtures that are part of the “standard unit” or original construction of each unit

Strata insurance does not usually include personal items and appliances that are part of a condo unit. It also does not cover the damages made by individual unit owners, such as in the case of water damage caused by a unit owner. These are usually covered by personal condo insurance.

Property types

Detached home: A detached home is your standard single-family home. It is a residential building that stands alone and is separately titled or legally a single unit.

Semi-detached home: A semi-detached home is similar to a detached home, except it shares a wall with another home. This pair of homes must make up an independent building and each should be separately titled or legally two separate units. There can only be two homes in a semi-detached building.

Townhouses: A townhouse is the middle between a detached/semi-detached home and a condo apartment. Like detached and semi-detached homes, they are often single-family units that have their own land and may be attached to other units. However, like condo apartments, they typically have to pay co-ownership fees for maintenance and may share some common features with their neighbors.

Condo apartment: This category includes all apartments and condominiums. These are complexes of residential units with common areas such as hallways, parking lots, stairwells, etc. They can be low-rise, mid-rise, or high-rise buildings. Unlike townhouses, there are no parts of the lot (the land of the building) where access is reserved for only one owner or occupant. There can be privately owned units and spaces inside the building.

Plexes are multi-story buildings with two to four individual units, usually one on each floor. They are a mainstay in Montreal and other cities in Quebec. Each unit is usually individually accessible via an external entrance with higher floors connected by staircases.

Property Classes

Freeholds: A freehold is any property where the owner owns both the house and the land it is built on. Common freehold property types include: detached, semi-detached, some townhouses, and farmland.

Condominiums: A condominium or condo is any property where the owner owns the home (or unit) but shares ownership of the land and other improvements with a condominium corporation. Common condominium property types include condo apartments and some townhouses.

Leasehold: Leasehold describes the situation where different entities own the land and the structure built on the land. Owner of the buildings has leased the land and pay rent to their landlord while owning the building on the land.